Senior Sophie Lage opens her Starbucks app and orders a Venti Iced Chai Tea Latte. This is an every other day occurrence for Lage. Based on her habits, Starbucks costs her approximately $22 a week, or $88 per month, or more than $1,000 per year.

In addition to Starbucks, Lage said a majority of her spending is on clothes. While her friends try to offer advice to reduce her spending, she said she normally still buys what she wants. However, Lage admits spending more money when she is making financial decisions independently.

“[My friends] try to get me to stop spending money a lot,” Lage said. “So I usually spend more money when I’m alone, and I make my own thoughts and choices, rather than with my friends when they try to tell me, ‘Oh, you don’t need that.’”

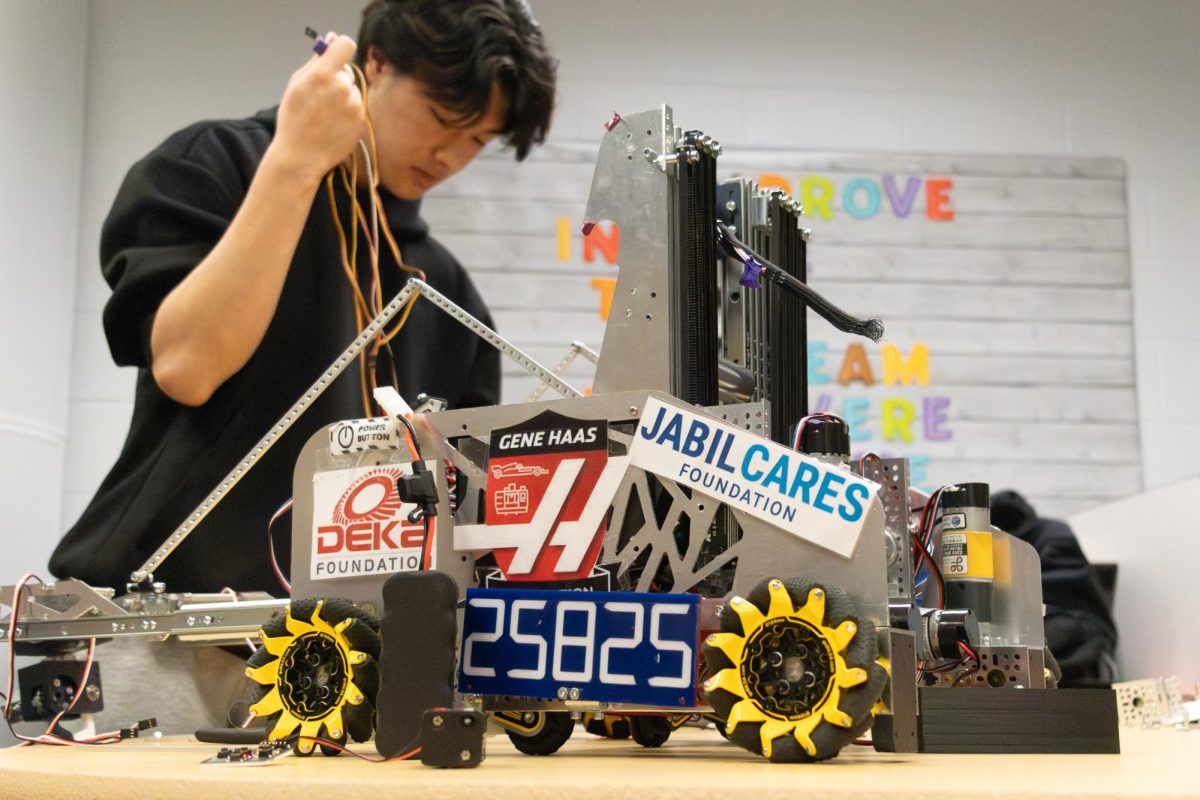

Junior Sean Lee, founder and co-president of BVNW’s Finance club, said he tries to spend his money wisely, however, he occasionally spends it on things he does not need like entertainment and clothing.

“There’s instances where I spend my money on stuff I shouldn’t, but I don’t let [myself] get too overboard because I always keep my spending in check,” Lee said.

The impulse to spend money on desires and enjoyment ultimately leads to overspending, Abby Foster, a wealth advisor at Mariner Wealth Advisors in Kansas City, said.

“I think sometimes our desire for fun things kind of outweighs our logical sense of what we should or shouldn’t be doing,” Foster said. “It’s easy to let the fun side of our brain drive the decisions we make, especially when it comes to money.”

Additionally, Foster said spending money has mental aspects to it, including providing an outlet to destress.

“I think money is very emotional in that it’s just a coping mechanism for some people. [Whether it is] shopping or maybe it’s purchasing food items, maybe it’s doing fun things with friends,” Foster said. “It’s all kind of a release.”

In addition to providing a way to unwind, Lage said spending money brings her happiness.

“It makes me feel happy because I am buying something I really like with my own money, and I am not feeling guilty by using someone else’s money, like my parents’,” Lage said.

An inclination to spend money can also arise when someone gets their first job, Lage said. When she first started working at Scheels, Lage said she no longer felt guilty when spending her money because she was making it herself.

“I don’t like spending [my parents’] money that much,” Lage said. “So once I got my first job, I was like, ‘Oh, I’m actually making real money, and I can buy things on my own,’ so I [decided] I might as well just spend it.”

Lee said that feeling a sense of guilt is not necessarily a bad thing when it comes to overspending.

“I think that [feeling guilty about spending] is a good thing because you shouldn’t be overspending your money anyway, so maybe a little sense of guilt is good for holding yourself accountable,” Lee said.

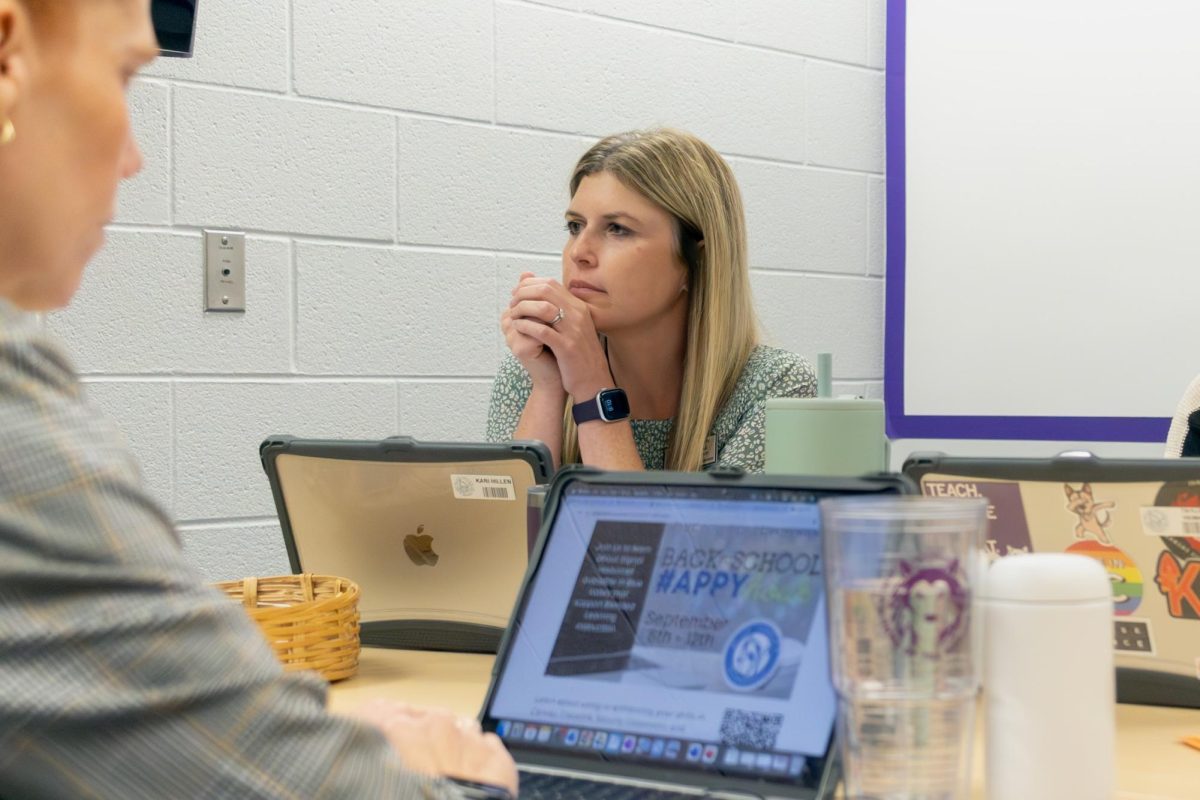

Business teacher Erin Izzo, who teaches a personal finance class, said she feels as though teens overspend because they don’t have pressing responsibilities such as rent.

“At this point, students might overspend because they don’t have many expenses they must pay for right now,” Izzo said. “Their income is mostly used to pay for things that are more nice, like going out, spending time with their friends, going to get something to eat and going to activities.”

Izzo said that as students don’t need to actively track their spending, it’s easy to forget how much money is actually spent when they can just buy whatever they want.

Additionally, Izzo said that one of the worst downfalls for teens who are not able to manage their income is that they won’t be disciplined with their saving habits. She said saving money as a teen sets the basis for how they will spend their money once they get a job.

Similarly, Foster said spending more than intended can become a detrimental habit as teens enter adulthood. This danger can come in the form of personal loans, credit cards and other financial pitfalls.

“If you’re used to overspending, that habit can become really dangerous,” Foster said. “If you start getting a credit card and maxing that out, those have really high interest rates and can eat into things really quickly and start you into a spiral of debt that’s super difficult to get out of.”

Izzo said the biggest thing a teen can do to create healthy spending habits is to create an automatic transfer, so a portion of their check goes into their savings account.

“Start off low, with maybe 10% of your check going directly into a savings account up to 20% or even 50% depending on what you think makes sense for you, but an automated savings is definitely going to help,” Izzo said.

Investing is also an effective way to maintain cost-effectiveness, Izzo said. She said to start saving early, and then figure out ways to invest money and grow it for the long-term. She said if teens start asking their family members for help to start investing, then a small portion of money can grow over time.

Coming up soon is Black Friday, the biggest shopping day in the United States. Foster said it is necessary to plan what to buy before beginning to shop.

“Just because something is on sale, [that] is not a reason to buy it,” Foster said. “Always have a plan before you go shopping and know what you’re looking for so you don’t get sidetracked by all of the fun things you see on sale.”

In addition to seasonal reasons, Foster said spending has increased due to inflation.

“I’ve definitely noticed people struggling more with the cost of inflation because a lot of the things that have grown in costs are not things that are discretionary,” Foster said.

As an adult, Izzo said she spends money responsibly by budgeting.

“[Spending money responsibly] means being able to track your spending, creating a budget, determining what you are planning to spend, prioritizing what your needs and your wants are, and then living that plan,” Izzo said.

Similarly, Foster said budgeting is a good way to set yourself up for success as an adult. She recommended a 50-30-20 budget. 50 percent of your budget is for needs, 30 percent is for wants, and 20 percent is for savings. However, as a teenager with fewer expenses, this can be altered.

“If you don’t have any spending on needs that you have to do, because you’re still living at home and your basic needs are covered, then you can use that other 50,” Foster said. “Maybe split it 50/50 so you’re saving half of your paycheck and then spending half of your paycheck.”

Izzo said the values an adult has when it comes to spending money are different than when they were teens because they have more financial obligations.

“As you have responsibilities, moving from your teenage years into your adult years, then of course that’s going to change where your priorities are gonna lie. When you have to support yourself and a family with places to live, food, and transportation, then that shapes how your spending plan gets created,” Izzo said.

![Senior Sophie Lage looks through clothes to find a new outfit for a football game. “I have gotten better [at saving money] but sometimes I still do struggle with saving money,” Lage said.](https://bvnwnews.com/wp-content/uploads/2023/12/Screen-Shot-2023-12-04-at-9.28.52-AM.png)